cryptocurrency tax calculator canada

Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while.

It is taxed either as business income or capital gains.

.png)

. Enter the sale date and sale price. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Download your tax reports in minutes and file with TurboTax or your.

Direct support for over 400. Generate ready-to-file tax forms including income reports for Forks Mining Staking. Ad Self-Trade Cryptocurrency In Your Retirement Account and Gain Huge Tax Advantages.

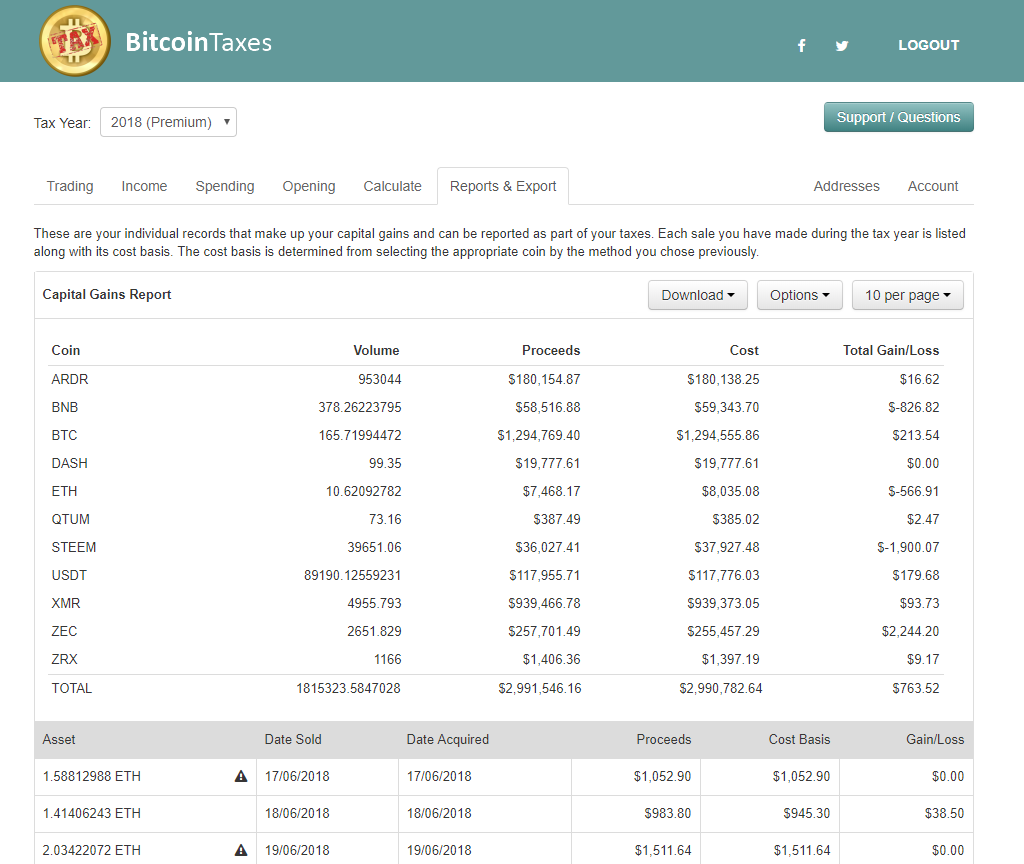

Become tax compliant seamlessly. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins. Sign in Bitcoin Tax Calculator for Canada Koinly is the only cryptocurrency tax calculator that is.

CoinTracker helps you become fully compliant with cryptocurrency tax rules. Ad Self-Trade Cryptocurrency In Your Retirement Account and Gain Huge Tax Advantages. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Whats crypto tax calculator crypto tax calculator is a software tool allowing users to calculate taxes on virtual currency trading activity. Establishing whether or not your transactions are. You can use crypto as an investment as a currency for spending or as a source of passive income.

The purchase date can be any time up to December 31st of the tax year selected. Canada has a couple of tax breaks that crypto investors will be interested in. Crypto Tax Canada Clear Filters CryptoTaxCalculator CryptoTaxCalculator The most accurate crypto tax software solution for both investors and accountants.

The Canada Revenue Agency CRA treats cryptocurrency as a taxable commodity. Crypto taxes in Canada are confusing because there are so many use cases for crypto. Only half your crypto gains are taxed.

The Senate reviewed the issue of. Youll only pay Capital Gains Tax on half your capital gains. This article will cover how cryptocurrency is.

High-Level Security Free Account Setup Transparent Pricing. Learn how to calculate and file your taxes if you live in Canada. Learn how to set up configure and use Koinly to generate your taxes and track your portfolio.

Capital gains tax report. The CRA says Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax Simply put. In this guide well break down Canadas cryptocurrency tax rules based on the latest guidance from the CRA and Revenu Quebec.

This guide discusses how. Cryptocurrency Tax Calculator. Enter the purchase date and purchase price.

Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains. High-Level Security Free Account Setup Transparent Pricing. They compute the profits losses and income from your investing.

Bitcoin Wallet Online Opus Cryptocurrency Schwab Buy Bitcoin Best Way To Invest In Bitcoin Bitcoin Telegram Bi Bitcoin Mining Bitcoin Mining Pool Buy Bitcoin

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Zec To Usd Calculator Coin Shop Canadian Dollar Dollar

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Coinbase Is One Of The Biggest Crypto Exchanges For Crypto Trading Budgeting Buy Cryptocurrency Tax Deducted At Source